Light vehicle emissions standards are a crucial part of a cost-effective strategy for overcoming market failures and behavioural barriers to more fuel-efficient and lower emissions vehicles. Introducing a light vehicle emissions standard in Australia is consistent with the government’s principles for best practice regulation.

Mandatory standards would complement the Direct Action Plan to reduce Australia’s emissions to 5 per cent below 2000 levels by 2020 and its centrepiece, the Emissions Reduction Fund.

Chapter 2 showed there are opportunities to reduce Australia’s greenhouse gas emissions by improving the efficiency of light vehicles. This chapter considers whether government intervention is required to realise these efficiency improvements and, if so, which policy tools to use. It asks:

- whether regulation of light vehicle emissions is necessary

- how market and behavioural barriers affect policy development

- what international experience can tell us about policy options to reduce light vehicle emissions

- which policy options would generate the greatest benefits in Australia

- how a light vehicle emissions standard might interact with the Emissions Reduction Fund (ERF).

3.1 Standards and the government’s deregulation agenda

The Commonwealth Government has placed a high priority on reducing red tape and unnecessary regulatory burdens on individuals, businesses and community organisations. The government has expressed concern that excessive regulation can deter investment and innovation, and stifle productivity (Frydenberg 2013). It has a target of reducing the cost of regulation by $1 billion per year (DPMC 2013).

The government’s approach is to ensure that ‘regulation is never adopted as the default solution, but rather introduced as a means of last resort’ (DPMC 2014, p. i). The Australian Government Guide to Regulation (DPMC 2014) sets out 10 principles for policy makers, designed to promote ‘better regulation, not more regulation’. The first three principles are:

- Regulation should not be the default option for policy makers: the policy option offering the greatest net benefit should always be the recommended option.

- Regulation should be imposed only when it can be shown to offer an overall net benefit.

- The cost burden of new regulation must be fully offset by reductions in the existing regulatory burden.

The government has made some changes to the process for developing regulatory policy. Australian policy makers have long been required to prepare regulation impact statements (RIS) for new policy proposals. A RIS clearly articulates a policy problem, identifies a range of options for solving it, and estimates the costs and benefits, in a broad sense, of the different options. The solution that provides the largest net benefit is the one that should be recommended. An additional step in the 2014 guidelines is that policy makers must identify ‘offsets’ in other areas—that is, regulatory burdens that can be removed. In this way, the overall level of regulatory burden on the Australian economy and community is unchanged by the new regulation (OBPR 2014, pp. 9–11).

The Authority has considered the main costs and benefits of options to improve the emissions intensity of new light vehicles. Mandatory light vehicle standards are likely to offer the greatest net benefit of available policy options. Standards could be complemented by enhancing existing information measures and better targeting light vehicle taxes and charges to encourage use of more efficient vehicles. The costs and benefits of an emissions standard are discussed in detail in Chapter 4. Further analysis, however, would be required to produce a RIS before this policy could be fully developed and implemented. This RIS would also include proposals for offsets from the existing regulatory burden. The Authority is not in a position to discuss regulatory impacts and offsets but would not expect to see such an attractive policy fall at this regulatory hurdle.

The rest of this chapter explains the Authority’s reasoning for proposing a light vehicle emissions standard.

3.2 Why is a policy response necessary? Market failures and barriers to improving vehicle efficiency

Energy efficiency policies generally—and vehicle efficiency policies specifically—help respond to the problem of climate change. They aim to reduce emissions of greenhouse gases into the atmosphere and thereby contribute to limiting the dangerous impacts of climate change. All countries need to implement strong emissions reduction policies over the coming decades if the global 2 degree goal is to be met. The subject of this paper addresses just one area—but a significant one—for potential emissions reductions in Australia.

Having established that there are opportunities to reduce emissions by improving the efficiency of light vehicles (Chapter 2), it is still necessary to establish that government intervention is required to realise those opportunities. Before regulating, policy makers will be interested in the light vehicle market and consumer behaviour. The main questions here are whether there are market failures or barriers that prevent consumers from realising the private financial benefits of more efficient vehicles and the social goods of reduced greenhouse gas emissions together with questions of improved energy productivity and security.

This is one instance of a larger question—whether private markets can be relied upon to deliver the socially best level of energy efficiency and greenhouse gas emissions, and whether regulatory intervention is likely to be beneficial in net terms, taking into account the administrative, compliance and other costs of regulation. Different types of barriers and impediments facing individuals and businesses can prevent markets from producing outcomes that maximise overall (social) wellbeing from vehicle choice—such as market failures, behavioural and cultural barriers, and other impediments.

Market failures are departures from the characteristics necessary for unregulated markets to deliver outcomes that maximise both private (household and business) as well as overall (social) wellbeing (PC 2005, pp. 45–66; OBPR 2014).

The most relevant market failures with respect to light vehicle efficiency are:

- problems with the amount and/or distribution of information in the market

- the absence of a market for greenhouse gas emissions (it is a ‘missing’ market).

Vehicle makers and buyers generally have asymmetric information about the costs of improving vehicle efficiency (Green 2010, p. 7). Vehicle makers know the relationship between fuel efficiency and additional vehicle costs for a large range of technologies, including those not currently included in their vehicles, while vehicle buyers generally only know (and can act on) the trade-offs between vehicle costs and efficiency that are currently on offer. If buyers undervalue efficiency improvements, or have limited capacity to assess the value of those improvements when making purchasing decisions (discussed below), then manufacturers have no incentive to supply vehicles that maximise private or social wellbeing.

In the absence of an incentive to reduce greenhouse gas emissions from light vehicles (either explicitly through a price or implicitly by regulation), the market for greenhouse gas emissions is ‘missing’. As a result, motorists will not take into account the social costs of the emissions they produce when driving, and emissions will be too high from the perspective of society as a whole.

Behavioural, cultural and organisational barriers can contribute to individuals or businesses not always making privately cost-effective choices about energy efficiency (PC 2005, p. 54). Current Commonwealth Government guidance notes that government intervention can be warranted in these situations (DPMC 2014, p. 24).

An important behavioural barrier is that any individual’s ability to obtain and process complex, changing and uncertain information is finite. In response to complexity, rather than calculate the best possible private decision, individuals tend to adopt rules-of-thumb. Such strategies include purchasing the same brand as a friend, purchasing the same brand that they have bought before, or using simplified choice criteria that focus on a subset of the features of a good (Green 2010, p. 8).

Evidence suggests these rules-of-thumb are prevalent in vehicle purchasing and affect the take-up of more efficient vehicles. While a recent survey found that Australians rate fuel efficiency and size as the two most important considerations when buying a car (AAA 2013, p. 13), there is very little evidence on how they assess fuel efficiency—particularly over the longer term. Calculating the benefits from improved fuel efficiency requires both specific information and strong mathematical skills, and is unlikely to be done by all purchasers or for all purchases (see, for example, ABS 2013). Evidence from overseas markets such as the US indicates that buyers behave as if they heavily discount future savings from reduced fuel use (see, for example, Green 2010, p. 17; IEA 2012a, p. 35).

These behavioural barriers are likely to have a more pronounced effect on household rather than business vehicle purchases. Nevertheless, there is substantial evidence that similar barriers can also prevent businesses investing in cost-effective efficiency improvements, especially when energy is a small and static share of overall costs (see, for example, ClimateWorks 2013). In addition, business buyers are likely to require payback periods of three years or fewer on a more efficient vehicle because most fleet vehicles are re-sold within this period. As just under half of new cars are purchased by businesses (NTC 2013), this ‘split incentive’ could limit the take-up of vehicles that would deliver overall financial benefits for motorists but not their first owner.

Other barriers and impediments such as the risk and uncertainty (around, for example, future fuel prices and the actual as opposed to tested fuel consumption of a vehicle) can also affect consumers’ choices.

3.3 Policies to improve light vehicle efficiency

3.3.1 Policy options

Any effective policy approach to reducing emissions from light vehicles must consider whether policy intervention is necessary, the range of policy options available and which is the best overall. The barriers to improving light vehicle efficiency outlined in Section 3.2 bear upon these considerations.

The deployment of technologies into new vehicles is much more practical and less costly than retrofitting existing vehicles (IEA 2012b), and more cost-effective than providing incentives for early retirement (IEA 2009, p. 192). This section, therefore, analyses options for improving the efficiency of the vehicle stock by improving new light vehicles. These options fall into five categories:

- No change (the ‘do nothing’ option)—the continuation of current policies, namely providing information on emissions intensity at the point of sale and via a government website (Chapter 2) and relying on the indirect effects of overseas standards.

- ‘Self-regulation’—most likely through the re-introduction of voluntary standards for new light vehicle emissions intensity. Past experience suggests any voluntary standards would likely involve an overall national target, without individual manufacturer targets or compliance arrangements.

- Information and labelling—programs that identify the efficiency, greenhouse gas emissions, fuel economy and/or running costs of new vehicles. These can help consumers to make informed decisions when purchasing a light vehicle by providing clear, trustworthy information. The information should be provided in a form that enables consumers to readily evaluate and compare different vehicles based on both the purchase price and operational costs.

- Fiscal measures—direct financial incentives to use more fuel-efficient vehicles, such as vehicle taxes and charges differentiated according to fuel economy or emissions. This category could also include carbon pricing schemes applied to fuels, and baseline and credit schemes. Baseline and credit schemes are discussed in Section 3.4; carbon pricing schemes are not considered further, being outside current government policy. Because congestion pricing primarily addresses the social costs of vehicle use in specific times and places, rather than their efficiency, it is not considered here.

- Standards—regulation that requires improvements in efficiency, such as mandatory light vehicle emissions standards. These are designed to oblige manufacturers to deploy fuel-efficient technologies more rapidly than they might otherwise.

Some combination of these types of policies may be implemented as a complementary package or they may operate as standalone measures. Several countries have introduced light vehicle emissions standards, alongside information and labelling requirements and financial incentives (IEA 2012b).

3.3.2 Comparing policy options for improving light vehicle emissions intensity

The Authority has considered the range of policy options and found:

- Despite ongoing improvements to its emissions intensity, the Australian light vehicle fleet remains less efficient than those of other countries and the benefits of contemporary vehicle efficiency technologies will not be realised without additional policy intervention.

- Voluntary standards in the past have not been effective in driving cost-effective and beneficial reductions in emissions intensity and are unlikely to be any more effective in the future.

- Information could be more effectively provided by following international best practice for consumer information and labelling but this is unlikely to be enough to realise the cost-effective emissions reduction opportunities that currently exist.

- States and territories could consider revising stamp duty and registration charges to create incentives to buy efficient vehicles. This could be done in a revenue-neutral way; for example, moving from existing schemes that differentiate charges according to technical characteristics to differential charges based on emissions intensity.

- Mandatory standards are considered the best approach to provide a cost-effective and technology-neutral way of overcoming the identified barriers to vehicle efficiency improvements, reducing emissions and enhancing Australia’s energy productivity.

The rest of this section analyses each of the options in turn.

The ‘do nothing’ option

Vehicle markets are global and, as discussed below, standards in other countries are becoming stronger over time (Table 3.1). This invites the question—‘Would Australia receive the benefits of mandatory standards applied elsewhere even if it does not impose any additional policies?’ If the answer is “yes”, Australia could reap the benefits of standards without imposing additional domestic regulation.

As noted, the efficiency of the Australian fleet has improved, and improvements have accelerated in the last five years, perhaps influenced in part by global manufacturers responding to the introduction of emissions standards in major overseas markets, and higher oil prices since 2005. This trend may continue as mandatory vehicle emissions standards in other countries become increasingly ambitious over the period to 2025. On the other hand, considerable recent research suggests that without a mandatory standard in Australia, the business-as-usual rate of improvement could slow from its recent average (3.2 per cent a year over 2009–13 to 2 per cent a year or fewer between now and 2020, increasing the gap between Australia and other countries (see Appendix B). Evidence suggests that Australia currently obtains some but not all of the benefits of mandatory standards that improve vehicle efficiency in other major markets.

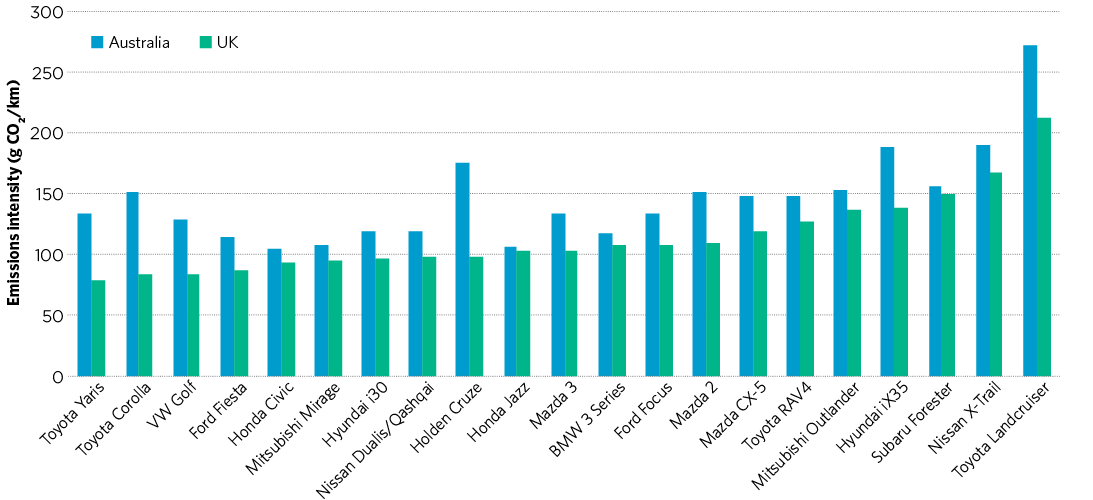

Australia imports 90 per cent of its new vehicles (see Chapter 2), and almost 75 per cent of new vehicles come from countries with mandatory standards in place. Nevertheless, the efficiency of Australian light vehicles remains well behind most other markets. These differences in emissions intensity of the Australian and other fleets are explained in part by the differences in the mix of models. Australia has more large passenger vehicles than some countries (NTC 2014). Even so, the variants of models offered in Australia are often less efficient than the same model sold in other markets. The most efficient variants of some models available in Australia consume about 20 per cent more fuel on average than the most efficient variant of the same make and model available in the UK (Figure 3.1).

Table 3.1: Global comparison of standards for passenger vehicles

| Jurisdiction and first compliance year | Basis for standard | Future target year/s | Equivalent CO2 target (g CO2/km) | Equivalent fuel economy target (L/100km) | Annualised percentage reduction (during each compliance period)^ | Annualised percentage reductions (various historical periods) |

| EU 2009 | CO2 emissions | 2015 2020* 2025** | 130 95 68–78** | 5.6 4.1 2.9–3.3 | Achieved in 2013 4.1 3.9–6.5 | 2000–09: 1.8 2009–13: 3.4 |

| United States 1975 | Fuel economy and GHG | 2020 2025 | 121 93 | 5.2 4.0 | 5.1 5.1 | 2000–13: 1.9 |

| Japan 1985 | Fuel economy | 2015 2020 | 125 105 | 5.3 4.5 | Achieved in 2011 1.4 | 2000–11: 3.2 |

| Republic of Korea 2006 | Fuel economy and GHG | 2015 | 153 | 6.5 | 2.2 | 2003–11: 4.0 |

| China 2004 | Fuel economy | 2015 2020** | 161 117** | 6.9 5.0 | 2.3 6.2 | 2002–12: 2.1 |

| India 2016 | CO2 emissions | 2016 2021 | 130 113 | 5.6 4.8 | 1.2 2.8 | 2006–12: 1.9 |

| Canada 2011 | GHG | 2016 2025** | 147 93** | 6.3 4.0 | 5.2 5.0 | 2000–13: 1.3 |

| Mexico 2012 | Fuel economy and GHG | 2016 | 153 | 6.5 | 3.8 | 2008–11: 2.6 |

Note: CO2 emissions and fuel economy for all standards normalised to European test cycle (NEDC). The coverage of ‘passenger vehicles’ differs by country—SUVs are included in the EU, Japan, Korea, China and India, and covered under ‘light trucks’ in North America. All countries except Korea and India also have targets for light commercial vehicles (or light trucks). GHG is greenhouse gases.

^For current compliance periods, annualised rate of reduction is calculated from 2013; EU 2020 target is calculated from 2013; Japan 2020 target is calculated from 2011; India 2016 target is calculated from 2012.

*This target has a one-year phase-in period; 95 per cent of vehicles must comply by 2020 and 100 per cent by 2021.

**Denotes target proposed or in development; Canada follows the US 2025 target in its proposal, but the final target value would be based on the projected fleet footprints.

Source: Adapted from ICCT 2014 and official sources listed under References

Figure 3.1: emissions intensity of best available variant of popular vehicle models, Australia and the UK, 2014

Source: Climate Change Authority based on Commonwealth of Australia 2014c and Department for Transport 2014

It is reasonable to expect that Australia will continue to realise some of, but not all, the benefits of standards applied in other countries—at least for those models and variants that are also supplied to Australian markets. It is likely, however, that global vehicle manufacturers will continue to allocate their most fuel-efficient vehicles and components to markets with mandatory emissions standards (DIT 2011a).

Self-regulation

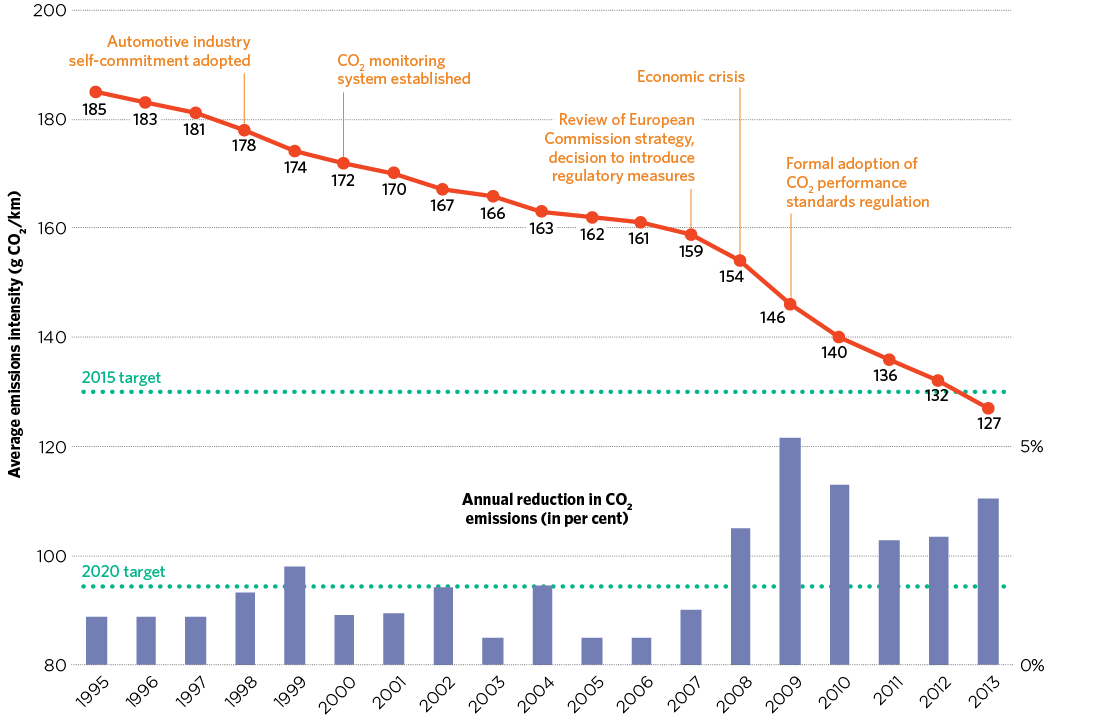

Both the identified barriers to improving vehicle efficiency, and Australian and international evidence, suggest that voluntary standards are likely to leave substantial benefits unrealised. If buyers undervalue fuel savings, manufacturers will be unlikely to comply with stronger voluntary standards because they cannot capture increased vehicle manufacturing costs through increased retail prices. This helps explain the failure of voluntary standards to drive significant efficiency improvements. It seems the EU had very modest improvements in vehicle emissions intensity during its period of voluntary standards, but this accelerated rapidly following the decision to introduce mandatory standards from 2009 (Figure 3.2).

The vehicle industry has an incentive to maximise its profits in selling vehicles, not to maximise benefits to motorists or society generally. In the absence of other imperatives, the Authority does not believe a voluntary standard will deliver a socially optimal outcome.

Figure 3.2: CO2 performance standards in the EU, new passenger cars, 1995–2013

Source: ICCT 2011b

In Australia, voluntary standards for light vehicle fuel economy and, later, emissions intensity were in place from 1978 to 2010. The voluntary standards accompanied improvements in fuel economy, but it is not clear whether these improvements were greater than business-as-usual trends. In 2003, the Commonwealth Government and FCAI agreed a voluntary Code of Practice to reduce the fuel consumption of new petrol vehicles to 6.8 L per 100 km (equivalent to 162 g CO2/km) by 2010. In 2004, the government and FCAI were unable to agree on an equivalent CO2-based target covering all light vehicles. Instead, the FCAI adopted a voluntary target of 222 g CO2/km for all light vehicles by 2010. The Code of Practice fuel economy target was not met, but the weaker emissions intensity target was achieved two years early, in 2008, and not renewed (DCCEE 2010; ATC 2009, p. 16).

Information and labelling

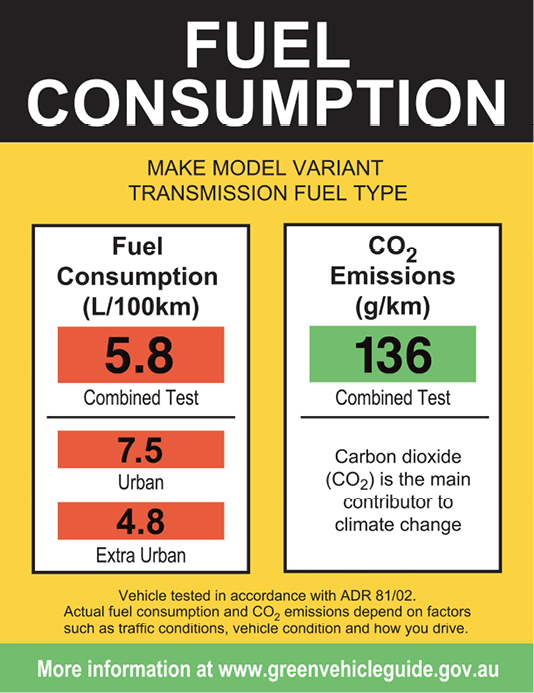

Labelling is a low-cost way to help consumers make informed purchasing decisions. Australian labelling currently provides ‘direct’ information about the absolute levels of emissions and fuel economy. All new light vehicles sold in Australia are required to display a fuel consumption label (Figure 3.3) (DIRD 2014b). The online Green Vehicle Guide provides this information in a format that allows comparisons to be made between different cars, along with a star rating that combines a greenhouse rating with an air pollution rating. The Guide also allows consumers to estimate fuel costs and emissions over time (DIRD 2014c).

Figure 3.3: Australian fuel consumption label

Source: Commonwealth of Australia 2014c

There is scope to make the information provided to consumers easier to understand. For example, the. The IEA (2012b, p. 21) has suggested that providing both direct and comparative ratings on labels is likely to be the most useful for purchasers. Examples are fuel economy labelling in New Zealand (Figure 3.4), the UK and the US. Australia and New Zealand have a shared labelling system for the energy efficiency of appliances (the E3 program, at www.energyrating.gov.au/(Opens in a new tab/window)). The Commonwealth Government could consider whether to enhance the usefulness of the label by adopting the widely accepted star ratings and including information about operating costs.

Figure 3.4: New Zealand fuel economy label

Source: New Zealand Energy Efficiency and Conservation Authority

This type of enhancement is likely to be low-cost (it uses information that suppliers already provide to government). Simply providing better information without further action is, however, unlikely to deliver the large, cost-effective reductions in emissions that Chapter 2 suggests are available as it does not resolve the price and other behavioural barriers to efficient vehicle purchase decisions.

Fiscal measures

Most countries tax vehicle ownership either annually or at time of purchase (or both). While these charges were traditionally based on characteristics such as engine capacity or mass, many countries have recently switched to charges that provide an incentive to purchase more efficient vehicles. Such taxes may have contributed to increasing the share of new lower-emissions vehicles and decreasing the share of new higher-emitting ones (IEA 2012b, pp. 32–4).

In Australia, vehicle ownership and registration charges are levied by states and territories. Registration fees tax the ownership of vehicles, rather than their use, so they do not effectively target the social costs of light vehicles (see, for example, Garnaut 2008, p. 527). States and territories could consider moving from existing registration fees and duties (differentiated according to vehicle value, mass or cylinder count) to differential charges based on emissions intensity. This would be consistent with the report of the Task Group on Energy Efficiency (2010), which concluded that a technology-neutral set of charges based on environmental performance would create better incentives to buy more efficient new light vehicles than the present technology-specific discounts (for example, for electric vehicles).

While vehicle taxes can influence vehicle choice, fuel taxes can influence both vehicle choice and ongoing use. Isolating the impacts of fuel prices is difficult but cross-country comparisons do suggest that countries with higher fuel prices have more efficient vehicles (IEA 2012b, p. 35). Higher fuel taxes, including the government’s recent proposal to re-index fuel excise, could increase this influence. This measure, however, would not address the information asymmetry and decision-making limitations discussed above. Further, unless the fuel tax is linked to carbon content of fuels, it also does not directly address the greenhouse gas externality. Given that higher fuel prices alone do not address these important market failures and barriers to improved efficiency, they would likely leave significant efficiency opportunities untapped.

Mandatory standards

A mandatory light vehicle emissions standard, possibly in combination with other measures, could increase the supply of lower-emissions vehicles to the Australian market. There is a broad consensus that a well-designed mandatory vehicle standard is an effective policy instrument. To this end:

- International analysis and experience shows that mandatory vehicle emissions standards are the global policy of choice for reducing light vehicle emissions, often in conjunction with information programs and fiscal incentives.

- Over 70 per cent of light vehicles sold in the world today, including those in the largest markets, are subject to mandatory vehicle emissions standards (CCA 2014a, p. 164) (see Table 3.1). Australia is one of only six of the 34 OECD countries without emissions standards. In several countries, including the United States, Japan and China, mandatory standards have been operating for at least a decade. The share of vehicles covered by standards is expected to grow, with emerging markets such as Indonesia and Thailand exploring their introduction. Many governments, including the European Union, United States and China, are accelerating emissions improvement through their successive standards.

- Garnaut (2008, p. 415–6) notes that simply providing more information may not be the answer to information barriers. He concluded that standards can be a cost-effective way of supporting the uptake of low-emissions options. To be cost-effective, standards need to be designed appropriately, with good knowledge of the costs and benefits, and sufficient lead time for industry to respond.

- A paper prepared for the Council of Australian Governments found that measures such as light vehicle emissions standards may be required to address market failures, such as information barriers, that are not adequately addressed by price incentives (ATC 2008, p. 36).

Of course, even an efficiency standard that has net benefits has some costs. The Productivity Commission (2005, p. 187) lists seven costs of minimum performance standards (MEPs) in respect of electrical appliances that could outweigh their benefits:

- administration and compliance costs

- mismeasurement of energy performance

- removing products from the market that are more cost-effective for some consumers

- forcing individuals to forego product features that they value more highly than greater energy efficiency

- reduced competition

- regressive distributional impacts

- increase in embodied energy consumption.

Because fleet average standards are—by design—more flexible than MEPs, not all of these concerns apply, and those that do are manageable through good design. In particular:

- Fleet-average standards do not require even the most emissions-intensive of current vehicles to be removed from the market: product diversity and consumer choice are retained.

- A reduction in competition consequent upon manufacturers withdrawing from the Australian vehicle market because of standards seems most unlikely, given all other major vehicle markets already have similar policies.

- A standard can be designed to maximise benefits, minimise regressive effects and minimise compliance costs.

Two additional objections are sometimes raised about vehicle standards—that they will lead to adverse health impacts because of an increase in diesel vehicles and that improved petrol quality is necessary for their implementation. These are discussed in Box 2.

Box 2: Objections to vehicle efficiency standards

Standards will require more diesel vehicles, which will lead to more air pollution

The introduction of light vehicle emissions standards could increase uptake of relatively more efficient light duty diesel vehicles, especially in the passenger vehicle sector. Air pollution standards for diesel vehicles have historically been weaker than those applying to petrol vehicles, leading to concerns that CO2 standards could inadvertently lead to increased air pollution, primarily particulate matter (which has the greatest health impacts) and oxides of nitrogen (NOx).

Australia has taken two key steps to mitigate air pollution and health risks from diesel. Firstly, it has enforced diesel fuel standards since 2002 that limit a range of fuel parameters, including sulphur, that contribute to particulate and NOx emissions. Secondly, it has adopted progressively stronger vehicle emissions standards for diesel vehicles under the Australian Design Rules (ADR). In particular, the more stringent ‘Euro 5’ air pollution standards being phased in from late 2013 (through ADR 79/03 and ADR 79/04) will drive reductions in allowable emissions of NOx and particulates from light diesel vehicles by 30 per cent and 80–90 per cent, respectively.

These measures to improve the quality of diesel fuel and control vehicle air pollution in Australia mean that the implementation of CO2 standards should not increase air pollution.

Better quality petrol is necessary for vehicles to meet CO2 emissions standards

The maximum allowable sulphur limit in Australian petrol is significantly higher than in other major vehicle markets. Some stakeholders have suggested that this is a barrier to Australia implementing CO2 emissions standards, but there is no compelling evidence to suggest this is the case.

Sulphur has no impact on vehicle CO2 emissions or the performance of CO2 reduction technologies, with the exception of ‘lean burn’ systems. Even in countries that have low sulphur fuel, however, this technology is rarely employed.

High sulphur levels in petrol do contribute to urban air pollution and can reduce the efficiency of technologies used to meet strong vehicle air pollution standards, such as the ‘Euro 6’ standards, which have previously been proposed for introduction in Australia from 2017.

Given these issues, government could appropriately assess the costs and benefits of a move to lower sulphur petrol.

Conclusion

C3. Both international experience and the principles of good policy design suggest mandatory vehicle emissions standards are a sensible policy for reducing light vehicle emissions. Standards could be complemented by enhancing existing information measures and better targeting taxes and charges to encourage more efficient vehicles.

3.4 Interaction of standards with the Emissions Reduction Fund

The government plans to introduce the Direct Action Plan to replace the carbon pricing mechanism and other elements of the Clean Energy Future Package. The plan’s centrepiece is the Emissions Reduction Fund (ERF). The ERF is an example of a ‘baseline and credit’ scheme–it will credit emissions reductions beyond a baseline of emissions or emissions intensity for a number of sectors, including transport, and may include penalties for emissions above historical levels (Department of Environment 2014).

The ERF will be designed to:

- identify and purchase emissions reductions at the lowest cost

- purchase emissions reductions that are genuine and would not have occurred in the absence of the ERF

- allow efficient business participation.

The Authority has reviewed the performance of baseline and credit schemes in Australia and overseas (CCA 2014b); this suggests light vehicle emissions standards would complement the ERF:

- Of the ERF-type schemes reviewed that do cover transport, large-scale transport emissions reductions were not achieved. Transport accounts for only a small proportion of total reductions achieved by these schemes to date.

- For light vehicle emissions reductions in particular, this is likely due to difficulties in setting credible baselines for private purchasers, which comprise about half of the light vehicle fleet.

- While there is scope for baseline and credit schemes to reduce road transport emissions, this is likely restricted to large private or public vehicle fleets, heavy vehicles and public transport. Each of these modes would appear to have the potential to present emissions reduction opportunities for the ERF additional to those achieved under a standard. This is contingent on sound accounting for interactions between a standard and the ERF.

Consistent with this analysis and the earlier discussion of barriers, the government noted in its ERF White Paper that:

… direct funding approaches may not be the most efficient means of increasing the uptake of more efficient vehicles or appliances because choices are often affected by non-price considerations such as size, colour, function and branding. This means that even relatively large incentives may do little to change consumer preferences. In these circumstances, emissions reductions are likely to be achieved more efficiently through other measures, such as minimum energy performance standards (2014, p. 40).

Overall, the Authority’s review suggests that light vehicle standards would likely complement the ERF and raise few new issues. The primary effect of standards on the ERF will be on the determination of baselines:

- A standard would set an effective baseline for changes in new light vehicle emissions across the economy. Any project or methodology baselines in the ERF would need to take this into account, in much the same way as it proposes to take into account the impact of standards such as National Australian Built Environment Rating System (NABERS) and Greenhouse and Energy Minimum Standards (GEMS) (Department of Environment 2014). This would not preclude crediting emissions reductions beyond that effective baseline, as long as reductions were genuinely additional.

- Parties liable under a standard may perform better than the standard. Depending on the Fund’s design, it may be possible for these extra reductions to be credited under the ERF. The methodology would need to address matters such as additionality and converting reductions from standards (in units of g CO2/km) to those purchased by the ERF (possibly t CO2-e).

These issues are discussed further in Chapter 5.

Conclusion

C4. A light vehicle emissions standard is likely to complement the Emissions Reduction Fund and other policies to reduce transport sector emissions.

3.5 Conclusions on policies for reducing vehicle emissions intensity

Overall, the Authority’s analysis of policy options to reduce emissions from light vehicles indicates that:

- Information programs such as fuel consumption labelling and the Green Vehicle Guide (see section 2.5) are a useful part of any policy package to improve vehicle emissions and there may be scope to enhance the information currently provided.

- Fiscal measures such as differential registration fees may be a useful complement to standards and could be considered further by state and territory road authorities.

- Emissions standards provide an effective policy tool for targeting the identified barriers to vehicle efficiency improvements. Voluntary standards are not considered to be as effective as mandatory standards, in part because of behavioural biases that result in consumers undervaluing vehicle efficiency improvements.